The Anti-Portfolio of Pharma

The unlikely intersection of overlooked diseases, overlooked assets and overlooked founders is the place we've called home for the past 10 years. When enough droplets come together they form an ocean.

There’s a concept in investing called the anti-portfolio, the ones that got away. An anti-portfolio is a counterfactual fund comprised of all the passed-on investments that later became fabled unicorns — much to the chagrin of the investor who talked themselves out of the deal or simply didn’t grok the founder’s vision. Perhaps the most recognized example of a public anti-portfolio is courtesy of Bessemer Venture Partners.

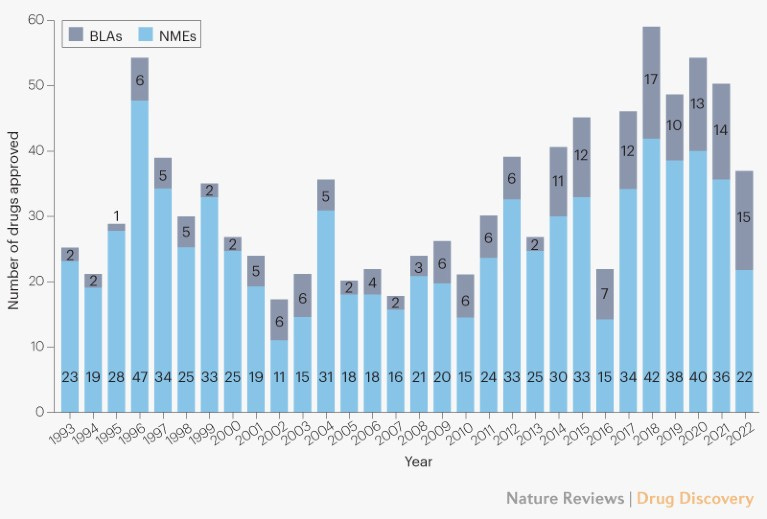

The concept of anti-portfolio is not much discussed in TradBio (traditional biotech) circles. Perhaps because the 90%+ failure rate of clinical trials has become so normalized. 2023 is being heralded as a bumper crop year with 55 FDA drug approvals. While that’s a healthy uptick from the 37 approvals in 2022, the number of approvals has wobbled around the 50 mark for the past seven years.

55 new drug approvals is not an annual high-water mark. 2018 boasted 57 approvals. In 1996, there were 53 approvals. However, famed drug hunter Dr John Lamattina, who oversaw global R&D for years at Pfizer, noted in a January 2015 Forbes commentary that 1996 was a fluke year in which FDA processed a backlog of approvals thanks to staff hires at the agency made possible by commercial sponsor user fees that had been enacted by Congress. As a sign that the rate of drug approvals is trending up despite a momentary COVID dip in 2022, Dr Lamattina’s piece was about how the year 2014 and its 41 new drug approvals spanning multiple modalities (not just small molecules, mind you) offered a glimpse into what felt like an imminent acceleration. 2015 went on to bag 45 new drug approvals.

Was the Pharma rocket ship about to take off? The very next year in 2016 there were only 22 approvals. Looking back over a 30-year window, the number of FDA drug approvals per year has ranged between 17 to 57. Of course many breathtakingly efficacious medicines have been approved in the modern era, including the first CRISPR medicine approved for sickle cell anemia a few weeks ago. There’s no question that the quality and diversity of new medicines is increasing unrelentingly, and dramatically.

But the output — the total number of drugs approved by FDA in a year — has stayed basically flat, though admittedly the last half-decade is averaging more drug approvals than the preceding five years. Medicine is not accelerating fast enough. The industry has come to accept process failure and capital inefficiency. $1 billion. 10 years. 99 busts. One success. Not good enough.

Inspired by the trajectory of SpaceX and the success rate of rocket launches over time, what will need to happen to 10X annual new drug approvals, from 50 to 500? What will it take for the 90% clinical trial failure rate to flip to a 90% clinical trial success rate? Remember SpaceX circa 2009 when every launch countdown concluded either in a scrubbed mission or a viral video of a half-exploded rocket?

Check out how SpaceX is doing today:

Medicine feels like it’s stuck where SpaceX was in 2009. Blowup after blowup. If your first reaction is to pin the blame on FDA or over-regulation, wrong answers. Or that Janssen and his contemporary drug gatherers picked the pharmaceutical tree clean of all low hanging fruit. Also, wrong answer.

The industry is not learning fast enough from its mistakes; not spending each dollar like it could be its last; not making ruthlessly dispassionate decisions at every step of the process based on hard data; and with the exception of COVID, not executing fast enough like our lives, and the lives of those we love, depend on it. After guiding pioneer families on their cure odysseys for almost a decade, we think we’ve found one path toward biomedical acceleration, or b/acc for short.

Anyone who has operated in the rare disease space over the last decade is all too familiar with the whiplash business cycle. 10 years ago, rare diseases were the talk of the town, the belles of the ball. Big Pharma companies launched rare disease divisions. The rare FOMO was real. At the peak of the 2020-2021 biotech bubble, a new preclinical platform company bragging about dozens of programs, even ultra-rare diseases with no actual viable commercial paths, was going public weekly.

Today, rare diseases are more like the unwanted stepchild from a previous marriage. Rare disease families are left to ask their friends, colleagues and neighbors: hey, brother can you spare a dime. Most of those biotech companies that IPO’d in the boom years are either dead, dying or have focused on one or two lead programs at the expense of their once mighty preclinical pipelines. Companies large and small are still shedding orphan assets — and shattering hopes.

In response to that extinction event — the industry wide de-prioritization of ultra-rare disease programs — Perlara coevolved alongside pioneer families into the first direct-to-consumer — more accurately, direct-to-family — biotech company. Genetic lightning keeps striking. Pioneer families emerge from the fog. Organically, just following the lead of those families, disease indications came into focus until they coalesced into a pipeline.

Instead of a modality or asset chasing a disease as is the norm in TradBio, Perlara empowers families to chase after their cures, to borrow drug repurposing champion Dr David Fajgenbaum’s expression. Perlara’s key insight was that rare disease communities are fragile and fleeting on their own but when linked together they form a battering ram of precision medicine that can break into the clinic faster and with high probability of success.

Bootstrapping the company since 2021 led to revenue-positive business development. Instead of spending time and burning runway trying to secure TradBio aka B2B partnerships, Perlara pivoted hard to a B2C “drug repurposing as a service” for pioneer families. We had to reimagine a distributed work flow involving fractional team members, month-to-month subscription access to a turnkey lab, as well as a hybrid yeast team with remote-first project managers and on-site staff scientists.

Perlara 1.0 (2014-2018) was centralized and operated by full-time employees. Perlara 2.0 (2019-present) is unbundled, a network of fractional consultants. We popped up a lab and focused internal resources on yeast. We outsourced worm, fly and fibroblast to academic partner labs, CROs or platform startups, and offered a consulting layer of project management, data analysis and collaboration choreography on top. We had finally found product-market fit.

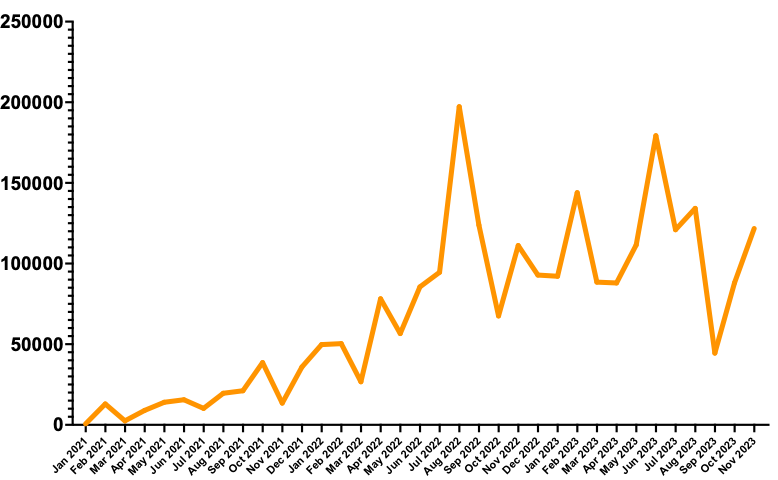

Perlara did $190,000 ARR in 2021. In 2022, we did $1,000,000 ARR, an increase of 5X. We’re still waiting on the audited numbers from the last month of the year, but 2023 revenues will be ~$1,350,000, which is 35% year-over-year growth. We haven’t paid a cent in marketing or sales. Pioneer families find us online via word of mouth, social media, earned media and Substack.

As a result of being totally modality agnostic, we’ve been able to build a business working on any overlooked disease, even the tiniest ultra-rare diseases where there are only 6 known patients in the United States, such as FAM177A1 deficiency. We are truly scale-free, or 1-to-N as we like to call it. As a result of focusing on (for some reason still) contrarian but more predictive disease models and the rare diseases to which they’re most well suited, we have been able to create commercial optionality and upside potential on a substrate of overlooked assets, even nutraceuticals and decades-old generics, by creating proprietary non-obvious combination therapies.

As a result of liberating ourselves from the shackles of a B2B2C business model that otherwise dominates the current system, we can partner with overlooked founders, parents of rare disease kiddos who are expected to make way for the professionals at some point. The result is the Anti-Portfolio of Pharma.

We tripled down on overlooked diseases, overlooked assets, and overlooked founders. Rivaling some of the biggest companies and most ambitious platforms in the industry, we’ve assembled what we affectionately call the Anti-Portfolio of Pharma: 22 programs, all made possible by pioneer families taking control of their medical destiny. Nine of the 22 programs are clinical stage, meaning trialed in at least one pioneer kiddo. Several n-of-1 studies have progressed to the n-of-few stage.

We’ve successfully run yeast-powered screens, worm-powered screens, fly-powered screens and cell-powered screens. Remarkably, a nutraceutical was the top hit — or in the top 3 — in half of all programs. The accessibility and safety profile of nutraceuticals only lowers the barrier to parent-led, bottom-up, single-patient observational studies, as we described last month for a n-of-3 study of ibuprofen for MAN1B1-CDG.

The bet is already paying off with Maggie’s Pearl, though we still have to get across the NDA finish line. In less than five years and for less than $5 million dollars, we have taken our flagship program for PMM2-CDG from a yeast hit to a fully enrolled pivotal Phase III study (NCT04925960). We believe there are many more baby biotechs like Maggie’s Pearl yet to be born.

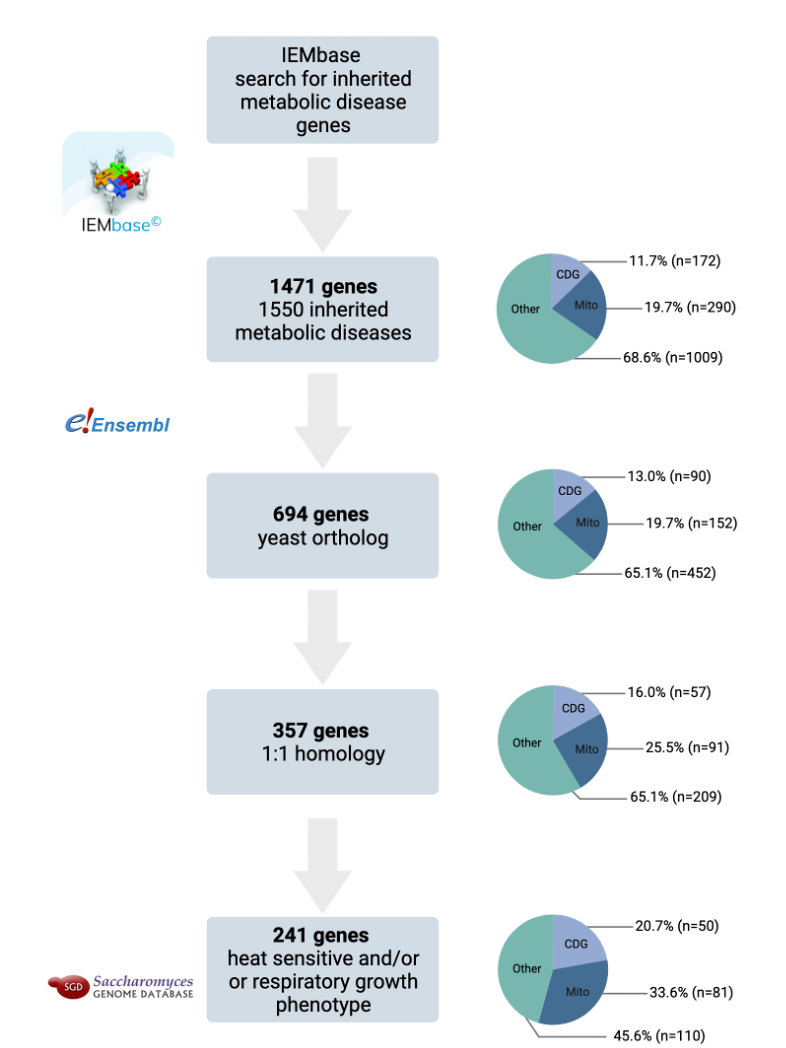

Our Anti-Portfolio is clearly enriched in inherited metabolic diseases. Congenital disorders of glycosylation, or CDGs, will be familiar to longtime subscribers of Cure Odysseys. Mitochondrial disease known collectively as Leigh or Leigh-like Syndrome are the next biggest group. To be clear we are truly disease agnostic, trekking to the far-flung corners of biology led by the unstoppable directive of pioneer families.

For example, a potassium channelopathy caused be a de novo variant in KCNC1. We’ve been cure guiding Stephanie Telesca and the KCNC1 Foundation for almost two years. We found KCNC1 drug repurposing candidates including a nutraceutical that we will take into the clinic this year. Our DTC approach serendipitously reveals diseases and genes that no one’s ever heard of because they’re so new to medicine. Even then we can ramp from 0 to 1. For example, the aforementioned FAM177A1 deficiency. The top hit from a just concluding fly-powered drug repurposing screen is a repositionable drug that is already in clinical trial for another indication. We’re in active discussions with the commercial sponsor about launching two single-patient INDs.

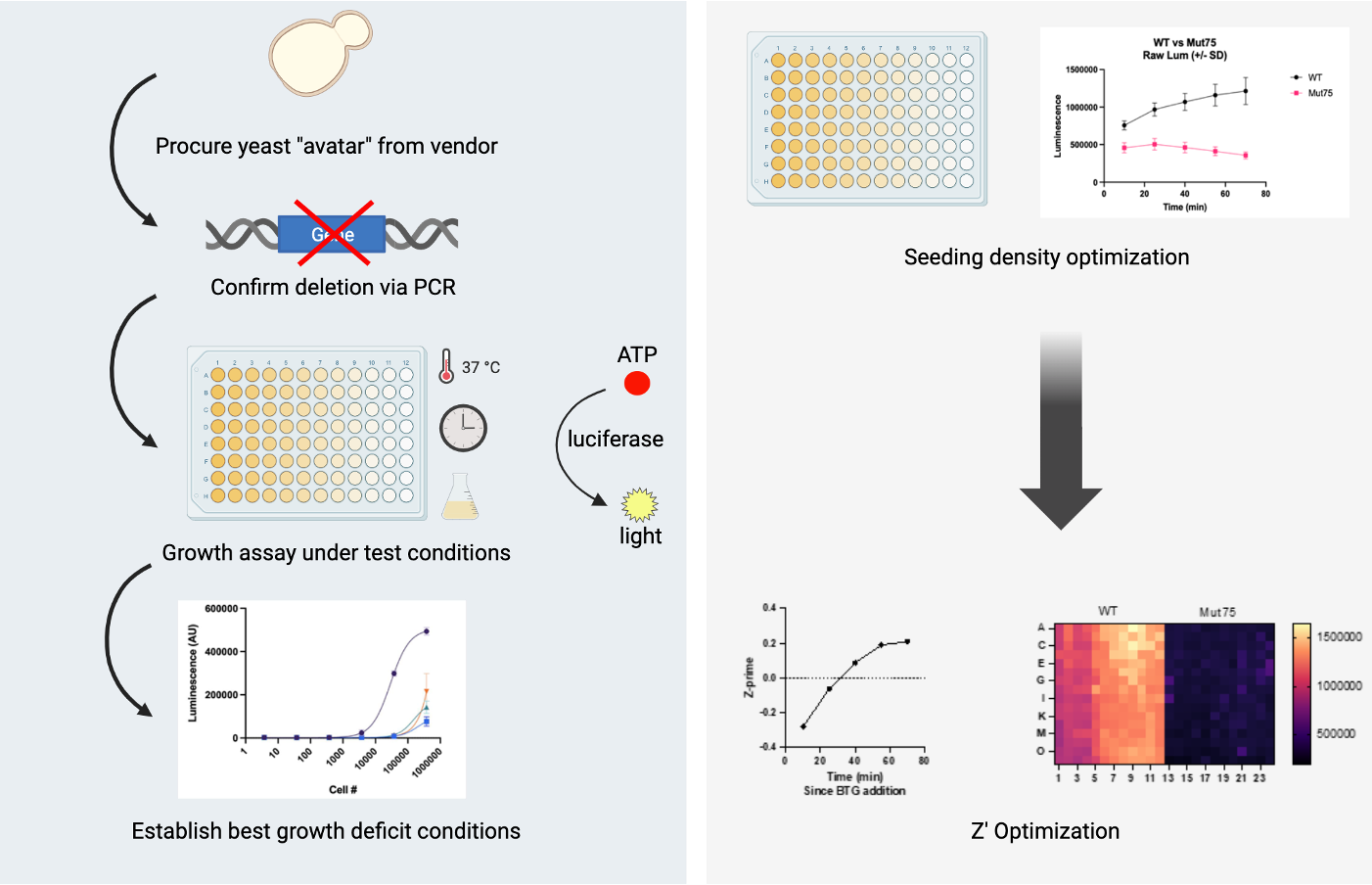

In the last year, we’ve focused on the potential of yeast itself as a drug repurposing platform. We’ve completed 12 yeast-powered screens, averaging one screen per month in 2023. We have translated directly from yeast to human in nine programs, leveraging the fact that 50% of hits are over-the-counter nutraceuticals or over-the-counter generics.

Despite the progress we’ve made, we’re still not moving fast enough. Instead of a reactive and bespoke approach where we wait for genetic lightning to strike families with the means and determination to pursue drug repurposing on their own one gene at a time, in 2024 we will shift to a proactive and standardized approach that takes advantage of pooling many yeast disease models and performing a single growth assessment of compound treatment on all yeast disease models at the same time.

Based on Perlara’s cumulative experiences over the past decade, it is time to industrialize yeast as a scalable and cost-effective drug repurposing platform for inherited metabolic diseases, which comprise approximately 15% of the 10,000+ rare diseases. Just focusing on a subset of inherited metabolic diseases, there’s an opportunity to ~20X our current pipeline from 12 yeast-powered programs to ~250 yeast-powered programs. And we’re building with others a distributed (90% at-home), sensor-driven, device-powered clinical trial infrastructure to keep up with the pace of clinical candidates flowing down the funnel.

Metabolism is so well conserved between yeast and humans that yeast have been used to delineate interconnectivity between different metabolic pathways, identify the roles of various metabolites in the pathway, and study perturbations in the context of diseased cellular states. While the use of yeast as disease models or the automation involved in pooled drug screens is not especially novel, Perlara’s innovation is the discovery that yeast are sufficiently faithful models of inherited metabolic diseases to be used as patient avatars and the application of these models at scale. The answer has been right under our noses the entire time.

The 22 programs comprising Perlara’s B2C/DTC drug repurposing pipeline are just the beginning of the latent biomedical acceleration that’s waiting to be unlocked. The 1-to-N clinical trial operational playbooks developed in the effort to scale drug repurposing will be generalizable to any intervention and all modalities, unlocking second-order exponentials.

Here's to a pipeline that we hope will launch a thousand cures!

It's always great to read the PCOs. This one was particularly energizing for the rare disease drug and nutraceutical communities. Let me know how I can help! Well done, Perlara Team!

Very impressive. Best wishes for accelerated success!!